Asset prices undulate. When they are rising, it seems that they will rise forever. Such are the times when the the most regretful trades are posted. When they are falling, the market depressively cannot imagine if and how they will ever rise again. With hindsight, however, we can see these cycles more clearly. Time, it seems, (if it's an asset of reasonable quality) makes good even the most ludicrous of trades. Take the Japanese stock market for example. Many [formerly?] credible investors have been bullish on Tokyo bourse share prices since 1993, that have only been made good in 2005 - a full twelve years later!! What is twelve years my younger readers might inquire??? The life span of a dog; three of four marriages for Elizabeth Taylor, or the duration of Nazi reign in Germany. Through whatever human lens it's viewed, it is a long long (and expensive!!) time...to be wrong.

Asset prices undulate. When they are rising, it seems that they will rise forever. Such are the times when the the most regretful trades are posted. When they are falling, the market depressively cannot imagine if and how they will ever rise again. With hindsight, however, we can see these cycles more clearly. Time, it seems, (if it's an asset of reasonable quality) makes good even the most ludicrous of trades. Take the Japanese stock market for example. Many [formerly?] credible investors have been bullish on Tokyo bourse share prices since 1993, that have only been made good in 2005 - a full twelve years later!! What is twelve years my younger readers might inquire??? The life span of a dog; three of four marriages for Elizabeth Taylor, or the duration of Nazi reign in Germany. Through whatever human lens it's viewed, it is a long long (and expensive!!) time...to be wrong. But that bubble was the now-distant past and it is currently the year 2006. The Tokyo stock market is booming once again, with small caps and mid-caps making all-time highs. And so is the art market, particularly for the Great Masters and impressionism where a near-frenzy exists. Supply is limited, of course, by the lack of new work by dead men and thus catapaulting REAL prices to levels not seen in either market since 1990. For that was the year that investors rang the bell on the TSE, thus allowing one now infamous Mr Ryoji Saito, scion of once-venerable Daishowa Paper, to "ring the bell" in the art market a GONG! that resonated so loudly that is was untouched and unmatched in real terms for more than a decade and a half!

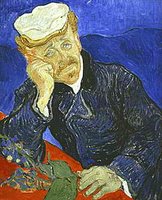

His story, or rather the story of his prey, is the subject of a book by Cynthia Saltzman, entitled "Portrait of Dr. Gachet: The Story of a van Gogh Masterpiece, Money, Politics, Collectors, Greed, and Loss". And while the details are fascinating and worthy of a read in greater detail, I will recount some of the history of Mr Saito, in the hope that by remembering and ruminating upon the folly of days past, we can increase the probability of preventing ourselves and others from making similar, if not the same financial mistakes.

OLIVER STONE: "GREED IS GOOD"

Like the internet bubble of the late 90's, and perhaps like Wall Sreet today, the late 80's were heady days. Recall "Barbarians at the Gate", and the new breed of brash and aggressive entrpreneurs that employed financial engineering techniques (read: 'Other People's Money') to make more money. They hadn't yet hit the introspective wall or been bitten by the philanthropy bug and were thus spending conspicuously pushing up the prices of, amongst other things, fine art. Christie's London sold a Van Gogh "Sunflowers" in March 1987 for a then auction record of $US39,921,750. The buyer: venerable Fuyo Group insurance giant, Yasuda Fire & Marine of Tokyo, who acquired it to display in their art gallery at head office.

"Later that year", Wikipedia tellls us, "Australian tycoon Alan Bond, winner of the 1983 America's Cup" (which Yankee yachtsmen had held for the previous 132 years) "successfully bid USD$53,900,000 at Sotheby's in New York for another now-famous Van Gogh, "Irises". Sadly, like a number of famous speculators, Mr Bond failed to repay the loan Sotheby's had given him to buy the painting, thus allowing the Getty Museum to acquire it from the auction house for an undisclosed sum. In 1996 Bond was sentenced to three years' jail for a $15m swindle involving the Edouard Manet painting La Promenade. In 1997, he was jailed for a further four years after pleading guilty to deceptively siphoning off $1.2bn from Bell Resources, to prop up his ailing Bond Corporation. It was Australia's biggest corporate fraud. He was released on parole in March 2000", though few outside Australia in the year 2006 (excepting the Newport crowd) will remember Mr Bond.

Enter Japanese industrialist Ryoei Saito, who in a 1990 Christie's auction bought a third Van Gogh, "Portrait of Dr. Gachet", for the then-amazing sum of $82,500,000 ($75 million, plus a 10 percent buyer's commission). The bidder on behalf of Mr Saito doubled the prevailing bid sending the room in gasps for air, followed by a gavel, making Vincent van Gogh's 'Portrait of Dr. Gachet' the world's most visible, and renown work of art.

SAITO & DAISHOWA

By the time of this landmark purchase, Ryoei Saito was very wealthy. He was not mega-rich by birth. Rather, he made his money in the paper industry, beginning some time in 1961, when he took his father's relatively modest paper company and apparently bullied his way into bigger companies' territory by undercutting their prices and raiding their clients.

According to the Ken Jacowitz' account, Saito took large financial risks to make Daishowa Japan's second-largest paper company. Such risks typically entail leverage (and lots of it) and so it was that The Sumitomo Bank took control of the company because of losses in 1982, most likely ripples from Volcker's assault of inflation that sent developed market interest rates into the high teens. Being tenacious, Saito managed to win back control of the Company by 1986, just in time to surf one of the biggest financial waves the world had ever seen! In hindsight this was probably caused by the unceasing pressure upon Japanese authorities to weaken the Yen by over-easing monetary policy and lowering Japanese interest rates to levels that supported and encouraged the most imprudent of speculations.

The lower rates didn't weaken the Yen, but merely fueled growth further ballooning asset prices, as well as Japan's relative wealth thus creating the heyday whence Japanese companies buying landmarks such as Rockefeller Center. It also allowed their billionaires to raid the West for treasures. Stories abound of western arbitrageurs front-running trades in Samurai swords, prior to near-certain acquisition at even headier prices in order to repatriate the treasure. Fine art, in particular, was considered - (mistakenly), as it turned out - a good investment, and Mr Jacowitz tells us, Saito sent a representative to a Christie's New York auction, with instructions to "pay whatever was necessary". And he could afford it. We know this because each year, the Japanese government makes public a list of the country's largest taxpayers. In 1990, Tokyo's Yomiuri Shimbun reported that Saito was Japan's largest taxpayer, contributing approximately $24 million to government coffers. His fortune was estimated at $770 million according to Inquirer art critic, Ed Sozanski.

THE TRADE

In business, Saito was nicknamed "wild fellow,". Emerging from international obscurity as he did when he paid USD$82.5 million to buy the melancholic portrait of van Gogh's physician, Paul-Ferdinand Gachet (who as it turns out also suffered from the same depression as van Gogh). According to Mr Jacowitz, the price was $33 million more than he had expected. And not more than two days later he paid a further USD$78.1 million for a Renoir known as "Au Moulin de la Galette," - the second highest price ever paid for a masterpiece at auction. Non-plussed, he told the press: "If other good ones become available, I will buy more and more". He said he would display the paintings publicly someday, and brought them back to wild acclaim in Japan, as if he won the country a national prize, only to stash them in a warehouse. It has been reported that Saito spent but a few hours admiring the portrait, before locking them both in his climate-controlled vault, where they remained for seven years. The American and European art worlds were stunned that the European masterpieces were going - not only of all places - to Japan, but to bubble-emboldened nouveau riche!

THE AFTERMATH: HOW THE MIGHTY FELL

How many a famous speculator subsequently have crashed & burned! The BOJ's tightening in 1990 diminished many a bubble fortune. Much of Saito's wealth was in overvalued forest lands, and when real estate values plummetted, so too did the value of Daishowa's forest lands, it's share price, and along with it, Mr Saito's fortunes. In an attempt to generate cash flow from his very leveraged land holdings, Saito proposed a golf resort and paid the governor of Miyagi Prefecture to get zoning changed from "forestry" to "development", an undertaking that was ignominimously to be named the "Vincent Golf Course". In December 1993, Saito was indicted on bribery charges.

Like Australia's Alan Bond, Saito pleaded guilty. Disgraced and broken,(the most severe punishment in itself in Japan), he was wheeled into the courtroom two years later to hear his sentence: "three years, suspended", following which he apologized tearfully (as one does in Japan and as we still hope Scooter Libby might do for knee-capping Joe Wilson). Around this time, Saito shocked the art world when he was said to have told friends that the Gachet portrait and the Renoir should be burned at his cremation so his heirs could avoid the billions of yen in inheritance tax. Later, he said that he was only joking. Six months later in 1996, at 79 years of age, Saito suddenly collapsed and died of a stroke.

THE AFTERMATH: WHERE'S GACHET GONE?

But were they his to burn? Were they posted as collteral, as so often is done by over-extended acquisitive noveau riche seeking notoriety by 'ownership' of masterpieces? Daishowa indeed HAD lots of debt, and in the post-bubble era, banks and creditors were keen to keep the cleaning of the mess as quiet as possible. It was likely that ownership of Gachet and the Renoir was disputed. Was it Saito's heirs, Daishowa, or were they now his creditors?? Few even knew where they were? Curators and auction houses tried to locate them. Company reps and spokesmen for the family assured the world that they were still around, though silence and secrecy surrounded all future movements. "Gachet", according to Wikipedia, "seemed to "simply vanish into the murky waters of the international art market". Three years passed with no public sighting or reliable account of its location or movements.

Saito's & Daishowa's main creditor, Fuji Bank (now the behemoth Mizuho - a product of the marriage between Fuji & Daiichi Kangyo banks) appeared to be the main creditor. But Japanese banks in general, and blue-blooded Fuji in particular, were loath to report on anything as embarassing as financing such absurd profligacy. Fuji repeatedly refused to comment on the painting. "I don't have an official report of what happened to the art. However, I presume that this painting is in the United States, in the East Coast of the United States," Toshitsugu Saito said, according to Sozanksi. "This is a world-class asset, so I am convinced that it was treated very properly and respectfully. But to tell you the truth, this is all that we know about it."

Sozanski reported that the Gachet portrait had gone so deeply underground that even Japanese art dealers familiar with the market could only guess as to where the painting might be and who has custody. One dealer, who spoke to Sozanski on condition of anonymity, tought the portrait was still in Tokyo, acquired as collateral by one of the financial institutions from whom Saito had borrowed money. "If a bank or other financial institution controlled the Gachet portrait, he continued, it would be extremely cautious in offering it for sale". "Japanese banks are very conservative, so they wouldn't admit that they controlled a painting or that they wanted to sell it," he said. "They would be afraid of making any mistake [because] they might be criticized by their board of directors."

It wasn't property of Daishowa Paper Company, said Iwao Sakamoto, a spokesman for the firm. He said the painting belonged to Mr. Saito, and NOT the company. He said they weren'r sure where it is, but that they heard that they sold the painting to somebody else. But the spokeperson said there is no truth to the rumor that Saito took the painting to his coffin. Ryoei Saito's son and now chairman of the company, Kiminori Saito, declined to comment. But from good accounts we know that a subsidiary of Daishowa Paper sold Saito's Renoir shortly after his death for USD$50 million to help repay debts which was - even at that price- a 26 percent loss before transactions costs, commissions, and opportunity cost. Although Saito's threat to burn the painting with his body were criticized at the time, they were regarded by those close to him as a joke. Sozanksi reported: "He didn't mean it literally. It's just that he appreciates the pictures that much," said Tokyo art dealer Hideto Kobayashi, who bid on the paintings for Saito."

WHAT"S BECOME OF THE BABY

Undoudbtedly there was some schaudenfraude about the fate of Saito. But the question remained where is portrait? His son said it is now likely gone from Japan, probably to the United States. But the question remains at the forefront of people's minds due to Saito's quip that he wanted the masterpiece placed in his coffin at his cremation (despite his retraction and subsequent clarification).

Saito's second son, Toshitsugu Saito, 54, a prominent member of the Diet (Japanese parliament) was quoted as saying "As the remaining family, we had to give up that art. I completely gave up my inheritance right. The van Gogh painting went into the hands of the creditors. It was the bank that had the substantial hold on it."

The Washington Post's Jacowitz cited two independent sources as saying that the auction house Sotheby's had paid several million dollars to Japanese creditors for a an option to sell the work. When that effort failed, Sotheby's forfeited the sum, Jacowitz's sources said.

Jacowitz interviewed Saltzman as to the pictures whereabouts. He quoted her as saying "I have since heard more reliably that it is in a European private

collection," but she doesn't know the present owner's name. "There were many rumors over the past few years that it had been sold, but whenever I would trace those rumors, they turned out to be just rumors."

In his same investagative piece, Jacowitz also said that "a Japanese magazine reported that a Christie's representative sold the painting in Switzerland. Several art dealers say stories swept through Tokyo last year that it was discreetly sold to someone in America. A Christie's spokesman in Tokyo refused comment".

Jacowitz also spoke to Anne Distel, chief curator of the Musee d'Orsay who'd recently put on a van Gogh exhibit about The Collection of Dr. Gachet. Distel was reported to have contacted the owner about borrowing the painting for the exhibition but was refused. Jacowitz speculated that the new owner was rumored, among others, to be Swiss art dealer Ernst Beyeler, a wealthy collector with his own museum, though he apparently denied the rumor.

Another report on German radio quoted the president of the International Auction Organization in Tokyo, as saying that the Gachet was sold in the United States for between $87 million and $130 million to a man who wished to remain anonymous, though the buyer was said to have no plans to display it publicly.

But that is all that is know. Nothing certain just hearsay and rumour. But interestingly, as we've waited for this most picture to resurface, it has since been surpassed by the 2004 sale of Picasso's 'Garçon à la pipe' a sign of the times that money is abundant, and asset prices are soaring.

Epilogue

What are we to take away from this intriguing story? First, that fortunes based upon inflated asset prices and leverage are potentially a toxic combination for both borrower and lender alike. Secondly, though it is possible that monetary policy will never be tightened again, accidents can still happen. The long rate is governed by the market, and though US policymakers and new Fed Reserve Chairman Bernanke talk a big, game, it is unclear WHAT they will do if faced with a rising long rates AND a collapsing US dollar in free-fall. Will they protect it? So even with the "Greenspan put-option" in force, speculators and those with leverage should be wary. Thirdly, though price momentum can often signal continuation of prices in the same direction in the future, serial occurances of this phenomena can take prices on severe divergent departures from equilibrium values, that dramatically diminish the prospect for additional momentum return. So much so, that like Japanese Stocks, or impressionit art, it might take 12 years OR MORE! Finally, as we see in Mr Saito, there are indeed people with more money than sense, and we can only hope that they, too, are soon bitten by the philanthropy bug to help their fellow human in whatever their (hopefully) humane and compassionate charitable pursuits...

No comments:

Post a Comment