Wanted: Trainee to learn the art of short-busting stocks with large short interest positions held by panicky, inexperienced, poorly informed or poorly capitalized short-sllers. Applicants should have a special interest in ramping highly accumulated or over-valued securities with established short interests. CFA, prior fundamental equity analysis not required, but experience in short-seller investor psychology, behavioral finance, making false and misleading statements, school bullying, thieving from widows and/or orphans or generally misogynistic behavior preferred.

I'll admit, you've never seen an "ad" like this. But according to last week's Wall Street Journal, these are people are real and exist in the flesh. The WSJ (& just for the record, let it be known that I strongly disapprove of their editorial policy) noted that a number of investors were rumored to readying themselves to play a game called "Get Shorty", a game in which they are said to buy more of the stocks that they, or others, have already bought in spades during the calendar year to-date. This past accumulation frequently accounts for such stocks stellar YTD returns in addition to often-elevated levels of short interest. The expectation is that additional rough and tumble ramping into the year-end will force the shorts to respond with the financial equivalent of the well-known bomb-shelter drill called "duck & cover". "Get Shorty" also provides the not unwelcome benefit of dramatically lifting the "end of year marks" on said favorite positions, thus allowing unscrupulous managers to pocket an otherwise less-than-deserved performance fee (or bonus) at their investors' collective expense.

Ruminating over the significance of what seems to be thought of as "harmless fun", I started thinking: How exactly DOES one learn to bust shorts? How has it evolved that some of the supposed best and best brightest financial minds of American capitalism have seemingly veered off down such a dark ignominimous road? And not only doesn't anyone appear to find anything wrong with it, they seem positively amused and admire it for it's ballsy ingenuity! Is this what Yankee cowboy capitalism has spawned - a world resembling some kind of financial Gomorrah ? Little more than a decade has passed since the corpse of the former Soviet Union's commmand economy imploded after failing miserably to attain anything like an efficient allocation of resources by willful neglecting an efficienct market. Might not our system, with its cariacature of market anarchy, suffer the same fate, arriving from the polar opposite direction?

I've never seen a course in predatory trading or short-busting in any MBA or PhD Econ guidebook. So where and how does one learn to play and orchrestrate such games with the market? It's important to distinguish this from ordinary healthy speculation, of the kind that's been around as long as the olive oil press has existed. Short-busting, on the other hand, is entirely different witht he distinct between "Murder-One" and "manslaughter" coming to mind. The former being conceived with bad intent, results from a concentration and abuse of market power. Not everyone can play, even if they want to. This is a game for the big, the elephantine, or the veritably gargantuan. Premeditation is also a helpful prerequisite, along with a bit of collusion (with other investors, brokers, and sometimes the company). For there are quarterly SEC filing requirements to skirt, and a host of other variables that will effect the economics of how much stock one might get, the higher one is willing to pay, not to mention the risk that the company itself might surprise you with a spot secondary or a jumbo-sized, low-premium mandatory, convertible issuance. Despite these risks, a truce generally exists between management and large shareholders since they NEED each other (in a Machiavellian way), even as their interests begin to diverge.

But what really makes it is possible, is the reality that markets are not perfect. A good "squeezer" knows, by trial and error, approximately how elastic the supply curve is for the free float for the stocks he's predating. Some have done this more systematically than others. Monroe Trout's primary strategy is supposed to have evolved out of cataloguing the impact of set order sizes upon an instruments' price at different times and under different conditions, and then measuring the subsequent effect. Sometimes, one triggers stops and it seems like Christmas-come-early. Other times, the market bids with you just because your bidding since the market is indeed reflexive. This sharply contrasts with the archetypical vision of markets which are that of a liquid and unbounded system. Reality more often resembles NOT infinite liquidity, but a finite and closed system. Here, only a fraction of shares are typically for sale in response to the recent change in price, so the squeezer who buys additional shares from liquidity providers (i.e. traders, specialists, market-makers, who don't own it but will facilitate the trade), and who is willing to buy more at higher and higher prices will, quite often, force the liquidity provider to buy the shares back from the purchaser at a higher price than that at which he sold them. The market may seem big and deep, (and it is for some of the largest stocks), but for the great majority of others, it's not much different than poker night with the boys. At this table, an oversized bankroll goes a long way towards creating unfair advantage in these games. And this would be harmless if only it WERE entertainment, and not the financial central nervous system of humanity, whose integrity is responsible for allocating scarce resources.

One might be thinking: "Why the f*%k should you care?" Well, call me an idiot, but when I see my neighbor being burgled, I telephone the police. When I see someone shoplifting, I notify the shop-assistant. When I see someone picking flowers from the public park, I chide them. It is the reflexive result of a good moral upbringing and strong civic pride. My late New-Deal Democrat-of-a-grandfather used to return his social security checks to the gov't because he was still working at age 78 and reckoned he "didn't need it just then". I fear it doesn't count for much in the ME! ME! ME! times of modern America, but I do think Scooter Libby could have used just a fraction of the integrity my grandfather had to 'fess up, and save us (the People of the USA) the millions spent by Mr Fitzgerald and his Grand Jury to investigate the retaliatory kneecapping of former ambassador Joe Wilson.

So what exactly is the harm of the frat bros hazing the shorts for fun and profit? First, it is - generally speaking - a divergent game that drives prices further from efficiency, which contrasts with many reputable short-sellers who simply provide liquidity or focus on uncovering fraud and divergent valuations. Interestingly, while Get Shorty alledgedly focuses upon stocks that have already been bought, and have already gone up, cheap stocks too tend to get cheaper during this period. Any look at the attribution of intermediate-term momentum returns across the calendar will confirm this. So this raises the question: is "Get Shorty" an independent short-squeezing game coupled with random underperformance of laggards, or is it a more integral part of a momentum-like, money-flow relative performance game? While clearly there are idiosyncratic exceptions, I would wager upon the latter. "Get Shorty" could be likened to a pathetic justification for an agent (i.e. an investment manager of a large investment pool) to throw more of someone else's money (the Principal, be it hedge fund investor, mutual fund investor, Pension Fund) at stocks with lower forward returns, in order to artificially (and temporarily) raise their prices, to insure the agent earns and crystallizes performance fees, collect incentive bonuses, or further their immediate performance rankings, and thereby enhance the value of the agent's investment management franchise. At best (where the players are skilled and manage to reverse the positions at a net profit), it is akin to an unauthorized "loan" from the principal investor to the agent, one which is quite adrift from the spirit implied in the princpal-agent relationship. At it's worst, for those who play the game clumsily (i.e. where net investment return is thrown away to the market), this is outright theft for parochial advantage, and is no different from the miscreants who profited from mutual fund timing.

But aren't they simply playing the game well, and winning? If Barry Bonds or Jose Canseco can make a $100 million, why shouldn't a ballsy clever financial games-player sitting in the hot seat at DOSH Partners be entitled to do the same? OK Maybe they are bad examples, because for starters, they were "juiced-up" and cheating. But the point remains: Why shouldn't the fittest survive in the market test of wits? Because, contrary to protestations from Bear Stearns in their "Kwiatoski Defense", financial markets are first and foremost NOT entertainment. They are mechanisms by which mostly educated and mostly skilled agents allocate the scarce resources of our world, making decisions that collectively provide the signals facilitating their movement from less productive undertakings to more productive endeavors. Theoretically, the efficiency by which they do this is essentially predicated upon the accuracy and efficiency of market price signals. This is why we SHOULD be concerned with whether or not stock options are expensed, or if management is smoothing profits through bogus accruals or dubious reinsurance contracts, or whether Telecoms companies are doing bandwidth swaps to paint false and misleading pictures of revenue thereby causing umpteen billions of dollars to chase illusory return in optical fiber and WDWM growth when they perhaps should have been investing in an LNG terminal, sour-crude refining capacity, or improvements to our healthcare or education systems. This is precisely why as a society, we SHOULD be concerned with whether our financial markets have integrity, or whether they are cynically viewed as enrichment schemes for those fortunate enough to be sitting in a catbird seat where, taking the traders' option, they can shoot the moon (and planet's aligning) and "win". But if price distortions are the result, the "victory is pyrrhic and impoverishes everyone in society. It is a vivid example of how the interests of the many, are minutely sacrificed for the larger gain of a few, that not only has no positive wealth gains for society, but results in probable wealth destruction from the resulting mis-allocation of resources. This holds unless one believes that the trickle-down effect from the Sheriff of Nottingham is a more potent economic motivator for the people of Nottingham and Sherwood forest than a world perceived as less corrupt, where more honest mannners of earning, exchanging, and investing one's wealth are transparent and just.

Whether or not one believes that Elliot Spitzer went too far in his prosecution of the market manipulation and bid-rigging in the insurance and reinsruance industries, one thing has been revealed with clarity: there were many otherwise decent soccer mom's and church-going dad's proceeding about their daily (corrupt) business practices, who came to see what they were doing (price-fixing, bid-rigging, kickbacks, extortion) as "normal", and even necessary. And everyone was worse off because of it, because everyone is effected by insurance markets to a greater or lesser degree. Squeezing shorts and other anti-social "financial market-as-a-game" equivalents, should be seen in the same light because everyone but the abuser of the privilege of their market power suffers. And for the record it must be noted that in a land where anti-trust still has traction even against the wealthiest man in the country, market size and power is a privilege with social responsibilities to many constituents, and NOT an alienable right irrespective of what some Ayn Randers, paranoid Republicans, or Supreme Court nominees might try and argue.

What can or should be done? First it must be understood that size and concentration of financial power - if abused - are the enemies of market efficiency, and thus the public interest. Markets may at times be peculiar and confound popular belief, but they are typically powerful positive forces and undeniably convey important information signals when they are large, deep, fair, and democratic. But I would be loathe to call a market "democratic" where large portfolio investors can buy monster amounts of stock unchecked, skirt regulations through numerous loopholes, collude with other participants in order to further abuse their size and power solely to garner parochial financial advantage.

The SEC can step up enforcement. Short-busting is illegal by the spirit of the law and regulations of the land. As a result they can demand more transparency of both short-sales and long purchases. They could also demand short-delay revelation of institutional investors' trades. And this could (should?!) include time and sales. No more hiding behind VWAPs. The tradeoff and responsibility for size must be complete and total transparency - on both the long and the short side (including all materially similar economic interests representing the same e.g. forward sales, swaps, OTCs bargains & options, futures, etc.). All of which should help make manipulation more difficult, which will undoubtedly make the market more efficient.

Unless in some strange kharmic sense, America somehow deserves to have resources allocated by trigger-men. Perhaps, rather than increasing the transparency, we need MORE short squeezes, more Enrons, more fraud, more dark unlit fiber. As a patriot, I reject this view and believe that money should be made from honest productive pursuits, rather than by stealing it. As a result, I believe financial regulation should endeavor to make it's policy and subsequent enforement on the very same basis to protect the vital integrity of our markets.

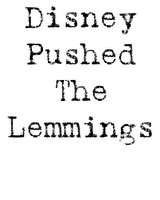

Animal metaphors are abundant when it comes to describing archetypical investor behaviour. Few are as visually exciting at that portrayed by L. Lemmus (the Common Lemming). Conjure an image of hordes of investors falling over themselves to acquire shares in JDS Uniphase, Northern Telecom, or Global Crossing, (or for our Japanese friends Softbank, Trans-Cosmos, or Jafco) during the bubble only to realize that, like the notorious lemming, they have been led over the edge the cliff, and that their portfolio is now in financial free-fall enroute to oblivion.

Animal metaphors are abundant when it comes to describing archetypical investor behaviour. Few are as visually exciting at that portrayed by L. Lemmus (the Common Lemming). Conjure an image of hordes of investors falling over themselves to acquire shares in JDS Uniphase, Northern Telecom, or Global Crossing, (or for our Japanese friends Softbank, Trans-Cosmos, or Jafco) during the bubble only to realize that, like the notorious lemming, they have been led over the edge the cliff, and that their portfolio is now in financial free-fall enroute to oblivion.  What IS real are the periodic cyclical population explosions of lemmings (sometimes increasing by 100-fold), and their subsequent rapid decline. But scientists never knew precisely WHY the populations dwindled after such massive expansions. Thanks to the careful observation of the nordic researchers, it has now been confirmed that the subsequent rapid dwindling are due to the quick responses of their main predators AND an increase in their rates of predation, the combination of which can reduce the lemming population by upwards of 2 to 3 percent per day! Though the original myth of mass-suicide was induced by hundreds of years of periodic sightings of numerous dead lemmings (typically around water) in Scandinavia, these apparently result from routine drownings during otherwise routine migrations, as they move through the swamps and lakes in the north. Lemmings, while good followers, are appparently poor swimmers.

What IS real are the periodic cyclical population explosions of lemmings (sometimes increasing by 100-fold), and their subsequent rapid decline. But scientists never knew precisely WHY the populations dwindled after such massive expansions. Thanks to the careful observation of the nordic researchers, it has now been confirmed that the subsequent rapid dwindling are due to the quick responses of their main predators AND an increase in their rates of predation, the combination of which can reduce the lemming population by upwards of 2 to 3 percent per day! Though the original myth of mass-suicide was induced by hundreds of years of periodic sightings of numerous dead lemmings (typically around water) in Scandinavia, these apparently result from routine drownings during otherwise routine migrations, as they move through the swamps and lakes in the north. Lemmings, while good followers, are appparently poor swimmers.