A Google Picture Search for "Saved by the Bell" surprisingly reveals smiling actors with bleached teeth, rather than the boxing metaphor that I myself would have associated with it. By most accounts, "Saved by the Bell" was a shockingly bad American TV sitcom that should have stayed down for the count, but ran more than a few seasons too many.

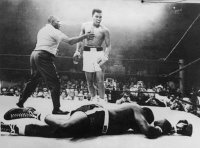

A Google Picture Search for "Saved by the Bell" surprisingly reveals smiling actors with bleached teeth, rather than the boxing metaphor that I myself would have associated with it. By most accounts, "Saved by the Bell" was a shockingly bad American TV sitcom that should have stayed down for the count, but ran more than a few seasons too many. It is the boxing metaphor, however, that is appropos with respect to the errr .... "hiccup" on the Tokyo Stock Exchange that led to yesterday's early halt of trading. For the mini-panic was apparently caused by a classic margin-puke or cascade of margin sales due to speculators requirement to "sell position to make position" or meet margin calls resulting from mark-to-market losses on collateral. Such is the danger of leverage, and speculation, in combination with dubious underlying value of securities, electronic execution, sell-stops as a risk-management tool, few non-speculative purchasers of securities traded, and high degree of consensus amongst speculators trading said securities.

Nonetheless, in the stock market, as in boxing, it IS possible to be "Saved by the Bell", allowing cooler heads to prevail, and potentially for margin to be located from other sources., or prices to subsequently bounce restoring the value of collateral. Or for the purported "plunge protection team" to come to the rescue. And where the cause of a "panic" is itself speculative and based upon sparse, fragementary or incomplete information, the added time may reveal that prior decisions to liquidiate might have been hasty (though I will withold judgement on this possibility).

In any event, for today, Speculators and holders of speculative and highly acumulated issues have been spared bloody and painful impalement upon their positions. The wise ones will thank their lucky golden buddhist toad and take the next plane to the Hawaiian Islands for a "thank-you, I'm not dead" beach holiday. The others tempting fate will, of course, shortly meet theirs, head-on.

No comments:

Post a Comment