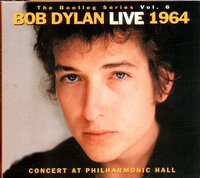

In 1964, songwriter extrordinaire Dylan wrote a song "Who Killed Davey Moore" about the senseless death of a prizefighter and the subsequent denial of responsibility by everyone culpable.

In 1964, songwriter extrordinaire Dylan wrote a song "Who Killed Davey Moore" about the senseless death of a prizefighter and the subsequent denial of responsibility by everyone culpable. Who killed Davey Moore,

Why an' what's the reason for?

"Not I," says the referee,

"Don't point your finger at me.

I could've stopped it in the eighth

An' maybe kept him from his fate,

But the crowd would've booed, I'm sure,

At not gettin' their money's worth.

It's too bad he had to go,

But there was a pressure on me too, you know.

It wasn't me that made him fall.

No, you can't blame me at all."

>(Rest of song's lyrics here)<

And apparently I. Lewis "Scooter" Libby is using the same type of lily-livered Nuremberg defense in trying to absolve himself from "Plame Blame" in outing Ambassador Joe Wilson's cloak-and-dagger wife.

Perhaps unsurprisingly, the virus of "Non Mea Culpa" has spread to the world of finance. In fact almost all the major financial villains of our new millennia have pleaded "not guilty" excepting those (Fastow, Sullivan, etc.) who've been coerced into turning state's evidence to shish-kebab the ostensibly bigger fish. Skilling, Lay, Rigas, Ebbers, Grubman, Scrushy, Stewart, Quattrone, Henry Yuen, Nacchio, Winnick, Kozlowski (to name but a few), all initially claimed innocence. Not one of them took responsibility for their actions. Not one of them attempted to set an example by doing "a Clinton" and embracing their guilt while in the same breath proclaiming they've seen the grave harm their actions, errors of judgement, and deceit have caused - not just to those directly affected financially by their actions, but through the pernicious effects of the fraud permeating the collective concious of society.

Teleport to London, and now we see Philippe Jabre, star trader and co-founder of GLG Partners doing precisely the same thing. Mr Jabre, long-time stalwart of the convertible bond, and risk arbitrage markets in London is accused of illegally acting upon material non-public information alledgedly provided by white-shoe bankers Goldman Sachs regarding the imminent issuance of a convertible bond. Mr Jabre is accused of making illegal profits by acting upon such material non-public information and selling short the shares of the issuing company in advance of the issue.

While the details of Mr Jabre's defense are not public, it will probably consist of "the Davey Moore defense" whereby he says (1) he acted on market rumors or heresay, not privileged material non-public information provided by an employee (??) of the advisor (GS) to the issuer; (2) this is SOP (standard operating procedure) in the market and at any given time the market is rife with rumor & innuendo both fabricated and real; (3) everyone does it - stock-loan departments, stock-brokers regarding takeovers, etc. (4) no one was harmed by it in any event since the stock price would have fallen anyway and he was merely contributing to market efficiency and thus doing a public service.

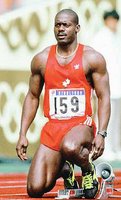

What are we to make this? What should we believe? My wise grandfather was known to say "Where there's smoke, there's fire". He also used to opine: "If you see a roach, there is usually more than one". And so it was that the same ensemble of GLG, Jabre and Goldman were rumored to be involved in the early 2003 unsavoury torpedoing and subsequent sinking of the (it must be said careless and excessively leveraged) Eifuku Hedge Fund. Just desserts some might say, so long as one is unfussed by petty details such as reputation, fairness legality, and chinese walls. My view is more sanguine, but no less indicting. I hold no malice or jealousy towards him and his firm, but look upon them as I look upon the Festina cycling team, or

Ben Johnson. Which is to say that success achieved through cheating is rather pathetic and hollow. Abnegating responsibility is even more shameful, though sadly unsurprising in our me-first version of modernity.

On that note, I'll leave you with some re-worked & updated lyrics to Dylan's poignant song,

sung of course to the tune of "Who Killed Davey Moore":

Who cheated, stole the money an' more,

Why an' what's the reason for?

"Not I," says the man at GLG,

"Don't point your finger at me.

I could've ignored the rumors and all

An' maybe kept me from my fall,

But my investors would've booed me I'm sure,

At not gettin' their returns and more.

It's too bad the FSA found out,

But there was a pressure on me too, all about.

It wasn't me to blame for the stocks' fall.

No, you can't blame me at all..."

No comments:

Post a Comment