As highlighted in my Jan 7th 2006 post on "ETF's & the Liabiity of Cap", many participants had just finished pursuing the cynically easy trade of buying smaller cap and selling index exposure. I posited that this depressed large and mega-cap returns (not just in Japan I would point out) and generated large performance fees for those fortunate enough to be sitting in the catbird's seat, possessing sufficient firepower to be the largest marginal buyer of some stocks for a few months. I suggested this would of course unwind in due time.

Checking back it is noteworthy that this "trade" is beginning to unravel (again, not just in Japan, but all the USA). This is perhaps best exemplified (for those interested in arcane but descriptive facts), that we are now witnessing a five-year low in the number of stocks that are outperforming the TOPIX index (on a rolling basis)over the previous 12 months. This number now stands at 40%. It has been falling for all of 2005, retreating from the very positive levels (approx mid 60's%) resulting from the pricking of the TMT bubble followed by the meaningful broadening of gaijin portfolios from their narrow "under-weight Japan" focus.

Now continued outperformance by high-momentum, coupled with a reversal of large-cap underperformance, has led to a brisk acceleration making it extremely difficult to "beat the index" without owning cap and high-momentum, which itself is risky if only because the high momentum securities are...well...so high and relatively poorer value than virtually anything else one might conjure the thought of adding to one's portfolio. It potentially has some more to run, but this seems likely to come - not from the outperformance of the positively skewed momentum portion, but rather from the largest and most neglected of the large caps that have been the whipping boys of many a hedge fund short portfolio.

Good things come to those who wait.

Tuesday, February 28, 2006

Friday, February 24, 2006

Free Money

What is "Free Money"? A convertible issue awarded at "par" when the secondary market is 105+ bid? An allocation of shares in a "hot" IPO at "issue price" where the WI-price is higher? Or perhaps one's annointment with a piece of privileged material non-public information that will have deterministic impacts upon the future market price of security.

What is "Free Money"? A convertible issue awarded at "par" when the secondary market is 105+ bid? An allocation of shares in a "hot" IPO at "issue price" where the WI-price is higher? Or perhaps one's annointment with a piece of privileged material non-public information that will have deterministic impacts upon the future market price of security. While UK fund manager GLG and co-founder Philippe Jabre vehemently deny that anything was askew with their short-sale of stock prior to the announcement of material corporate financing news (at least as far the one they are specifically accused of), and with GLG itself stressing that there will be no disciplinary action related to their oversight of Mr Jabre, the complete opposite is happening on the other side of the planet in Japan. For this morning, Japan's largest financial publisher the Nihon Keizai Shmibun (Nikkei) which is their equivalent of the FT or WSJ, immediately cut the pay of its President and two senior executives as a result of accusations of insider trading by a Nikkei employee and an official investigation, according to Bloomberg Business News. The 30-year old employee was alledgedly front-running front-page announcements regarding stock-splits, secondary offerings, and other market-moving corporate actions. In addition to the President's pay cut, ALL Board members will take a 1-year 10% pay cut, the head of the accused employee's division will resign, and all employees in the advertising division will be instructed to refrain from trading stocks.

The contrast between cultures and organizations is striking. Both organizations were caught with their hands in the cookie jar, yet one has embraced and addressed the accusation, even before the investigation has been completed, while the other has dug in its heels, however implausible its explanation may be. Interestingly, Nikkei is NOT a public company, and is not beholden to regulators or Sarbanes-Oxley criteria, yet they still have been widespread in their self-apportionment of responsibility, actions from which "Scooter" Libby & the Bush Administration, Secretary Rumsfeld & the US Military in respect of the Abu Ghraib scandal, and yes, GLG, could indeed learn some valuable lessons.

Tuesday, February 21, 2006

Motherf*#%ed !!

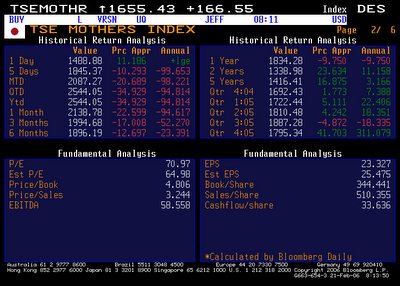

Anyone doubting the impact of the Livedoor debacle need only glance upon the chart of the TSE "Mothers" Index (source: Bloomberg LP) to the left. Without peering more closely into financial history, I would offer that the pictured carnage more than likely set an historical record for 22-trading day index price decimation in an advanced industrialzed country (including March 2002 Nasdaq, January 1990 Nikkei, and yes, October 1929 Dow).

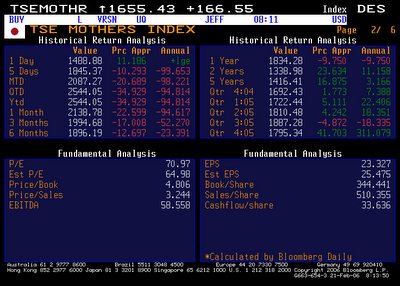

As with many things Japanese, the index's moniker lends itself to various amusing double entendres and picturesque puns that in all likelihood poingnantly express the feelings of aggrieved investors unfortunate enough to have held this index of securities of the past month, year, or, for that matter, five years, as exemplified in historical returns section (top right) of the second picture (source: Bloomberg LP) below. Despite the robust and wisdespread recovery in Japanese share values that has seen other small and mid-cap indices vault to new all-time highs, the hare-like (of Aesops fame) TSE Mothers has barely outpaced the meager returns yield by ZIRP deposits.

Yet despite the recent "Sherman's March" of prices, this Savannah-of-an-index seems to my frugal and conservative eye, to still lack the attributes I find attractive in an investment - chiefly some kind of tangible value or at least the likely delivery of value in the reasonably imminent future. Admittedly, the TSE Mothers has never been the place to look for such sober characteristics. Rather, it might be termed a "Godwanna of Growth", a "Fountain of Fashion", or a "Cornucopia of Dreams" since it's constituent members are indeed undertaking innovative and novel enterprise that often change and destroy historical business practices. And their leaders and employees are indeed youthful, vigourous and by many accounts, visionary. The only thing perhaps lacking (besides grey hair) are valuations commensurate with likely future cash flows that would reward an investor by bestowing upon her returns in the form of a stream of future dividends in combination with an enterprise sporting a future market value sufficiently higher than the amount initially paid to compensate her for her (in light of Livedoor) rather large if not total risk of loss.

Historically, such bush league enterprises as are Mothers' members would have remained in private hands until they yielded longer and more established records of profitability. But then "bungee jumping" and other thrill-seeking instant gratification sports didn't exist thirty years ago either. Investors sought these thrills. They DEMANDED them, jealous as they were of Masayoshi Son, Sergey Brin or Kleiner-Perkins. But then, people also DEMAND "Big Macs", HumVees and anything laden with the magical combination of sugar-coated trans-fats, so "the people" are not setting the bar very high.

Understand that I am not predicting the further demise of the Mothers. In this respect, growth and growth-oriented investors are, to my mind, from Neptune, and their fickle market whims and fancies cannot be easily fathomed using common or facile investment metrics. Suffice to say recovery is likely. Volatility is virtually assured. But the only thing that is truly certain is that I (and my investors and our collective investment pool) will NOT be present there.

As with many things Japanese, the index's moniker lends itself to various amusing double entendres and picturesque puns that in all likelihood poingnantly express the feelings of aggrieved investors unfortunate enough to have held this index of securities of the past month, year, or, for that matter, five years, as exemplified in historical returns section (top right) of the second picture (source: Bloomberg LP) below. Despite the robust and wisdespread recovery in Japanese share values that has seen other small and mid-cap indices vault to new all-time highs, the hare-like (of Aesops fame) TSE Mothers has barely outpaced the meager returns yield by ZIRP deposits.

Yet despite the recent "Sherman's March" of prices, this Savannah-of-an-index seems to my frugal and conservative eye, to still lack the attributes I find attractive in an investment - chiefly some kind of tangible value or at least the likely delivery of value in the reasonably imminent future. Admittedly, the TSE Mothers has never been the place to look for such sober characteristics. Rather, it might be termed a "Godwanna of Growth", a "Fountain of Fashion", or a "Cornucopia of Dreams" since it's constituent members are indeed undertaking innovative and novel enterprise that often change and destroy historical business practices. And their leaders and employees are indeed youthful, vigourous and by many accounts, visionary. The only thing perhaps lacking (besides grey hair) are valuations commensurate with likely future cash flows that would reward an investor by bestowing upon her returns in the form of a stream of future dividends in combination with an enterprise sporting a future market value sufficiently higher than the amount initially paid to compensate her for her (in light of Livedoor) rather large if not total risk of loss.

Historically, such bush league enterprises as are Mothers' members would have remained in private hands until they yielded longer and more established records of profitability. But then "bungee jumping" and other thrill-seeking instant gratification sports didn't exist thirty years ago either. Investors sought these thrills. They DEMANDED them, jealous as they were of Masayoshi Son, Sergey Brin or Kleiner-Perkins. But then, people also DEMAND "Big Macs", HumVees and anything laden with the magical combination of sugar-coated trans-fats, so "the people" are not setting the bar very high.

Understand that I am not predicting the further demise of the Mothers. In this respect, growth and growth-oriented investors are, to my mind, from Neptune, and their fickle market whims and fancies cannot be easily fathomed using common or facile investment metrics. Suffice to say recovery is likely. Volatility is virtually assured. But the only thing that is truly certain is that I (and my investors and our collective investment pool) will NOT be present there.

Monday, February 20, 2006

Blame Game

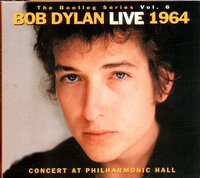

In 1964, songwriter extrordinaire Dylan wrote a song "Who Killed Davey Moore" about the senseless death of a prizefighter and the subsequent denial of responsibility by everyone culpable.

In 1964, songwriter extrordinaire Dylan wrote a song "Who Killed Davey Moore" about the senseless death of a prizefighter and the subsequent denial of responsibility by everyone culpable. Who killed Davey Moore,

Why an' what's the reason for?

"Not I," says the referee,

"Don't point your finger at me.

I could've stopped it in the eighth

An' maybe kept him from his fate,

But the crowd would've booed, I'm sure,

At not gettin' their money's worth.

It's too bad he had to go,

But there was a pressure on me too, you know.

It wasn't me that made him fall.

No, you can't blame me at all."

>(Rest of song's lyrics here)<

And apparently I. Lewis "Scooter" Libby is using the same type of lily-livered Nuremberg defense in trying to absolve himself from "Plame Blame" in outing Ambassador Joe Wilson's cloak-and-dagger wife.

Perhaps unsurprisingly, the virus of "Non Mea Culpa" has spread to the world of finance. In fact almost all the major financial villains of our new millennia have pleaded "not guilty" excepting those (Fastow, Sullivan, etc.) who've been coerced into turning state's evidence to shish-kebab the ostensibly bigger fish. Skilling, Lay, Rigas, Ebbers, Grubman, Scrushy, Stewart, Quattrone, Henry Yuen, Nacchio, Winnick, Kozlowski (to name but a few), all initially claimed innocence. Not one of them took responsibility for their actions. Not one of them attempted to set an example by doing "a Clinton" and embracing their guilt while in the same breath proclaiming they've seen the grave harm their actions, errors of judgement, and deceit have caused - not just to those directly affected financially by their actions, but through the pernicious effects of the fraud permeating the collective concious of society.

Teleport to London, and now we see Philippe Jabre, star trader and co-founder of GLG Partners doing precisely the same thing. Mr Jabre, long-time stalwart of the convertible bond, and risk arbitrage markets in London is accused of illegally acting upon material non-public information alledgedly provided by white-shoe bankers Goldman Sachs regarding the imminent issuance of a convertible bond. Mr Jabre is accused of making illegal profits by acting upon such material non-public information and selling short the shares of the issuing company in advance of the issue.

While the details of Mr Jabre's defense are not public, it will probably consist of "the Davey Moore defense" whereby he says (1) he acted on market rumors or heresay, not privileged material non-public information provided by an employee (??) of the advisor (GS) to the issuer; (2) this is SOP (standard operating procedure) in the market and at any given time the market is rife with rumor & innuendo both fabricated and real; (3) everyone does it - stock-loan departments, stock-brokers regarding takeovers, etc. (4) no one was harmed by it in any event since the stock price would have fallen anyway and he was merely contributing to market efficiency and thus doing a public service.

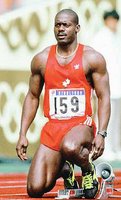

What are we to make this? What should we believe? My wise grandfather was known to say "Where there's smoke, there's fire". He also used to opine: "If you see a roach, there is usually more than one". And so it was that the same ensemble of GLG, Jabre and Goldman were rumored to be involved in the early 2003 unsavoury torpedoing and subsequent sinking of the (it must be said careless and excessively leveraged) Eifuku Hedge Fund. Just desserts some might say, so long as one is unfussed by petty details such as reputation, fairness legality, and chinese walls. My view is more sanguine, but no less indicting. I hold no malice or jealousy towards him and his firm, but look upon them as I look upon the Festina cycling team, or

Ben Johnson. Which is to say that success achieved through cheating is rather pathetic and hollow. Abnegating responsibility is even more shameful, though sadly unsurprising in our me-first version of modernity.

On that note, I'll leave you with some re-worked & updated lyrics to Dylan's poignant song,

sung of course to the tune of "Who Killed Davey Moore":

Who cheated, stole the money an' more,

Why an' what's the reason for?

"Not I," says the man at GLG,

"Don't point your finger at me.

I could've ignored the rumors and all

An' maybe kept me from my fall,

But my investors would've booed me I'm sure,

At not gettin' their returns and more.

It's too bad the FSA found out,

But there was a pressure on me too, all about.

It wasn't me to blame for the stocks' fall.

No, you can't blame me at all..."

Friday, February 17, 2006

The Pitfalls of Speculation

History is not kind to the corporate entity, just as speculation is typically the bane of the amatuer or inexperienced investor. Moody's is a notable exception and survivor - still in the financial publishing business after more than a century. 2006 marks the 100th anniversary of a little known "book" (pamphlet) published by The Moody's Corporation, penned by one Thomas Gibson and entitled "The Pitfalls of Speculation", which has generously been reprinted by the son of a former Chase Manahttan Bank Chairman, who is now the proprietor at Fraser Publishing, located ironically in the socialist capital of America: Burlington Vermont.

What is fascinating about Mr Gibson's market musings is that despite the on-rush of modernity, rather little has changed in the world of stock market speculation. Recall that 1906 was before the jarring market 1907 break to occur the following year; before the first world war and market carnage, before the roaring twenties, before the crash and subsequent depression, and of course before computers, Fidelity and yes even Louis Ruykeyser hard as that may be to believe. In honor of the centennary of Mr Gibson's observations, I will summarize his thirteen major observations here for you (as he did in his foreword), after which you can make your judgements as to the extent to which the speculative state of affairs might have changed.

1. The greatest causes of loss in speculation are ignorance, over-speculation, and carelessness (listed in order of importance)

2. The popular fallacy that business methods are not applicable to speculation is wholly erroneous.

3. Not 1 speculator in 1000 applies ordinary business precaution to his trades nor founds his ventures on values.

4. The correct trader has little to fear and much to gain from manipulative tactics.

5. While extremes of prices move in irregular cycles, no "system" for judging changes is possible or tenable as such mechanical attempts to forecast prices changes do not contemplate changed conditions , or provide for accident.

6. The general idea that actual value and probable future value of a property cannot be intelligently based, is erroneous

7. The greatest speculative profits are made in stocks. The greatest speculative losses are made in commodities.

8. There are certain technical stages or conditions of markets which are followed by invariable results, the study and recognition of which is valuable, and not difficult.

9. Almost every general idea of speculation is the exact reverse of the truth. Somethimes this is caused by false reasoning, but most frequently as a result of false appearances of market quotations.

10. Persistent short-selling is fashionable amongst certain classes of semi-professional traders, but almost invariably results in loss.

11. "Tips" are illogical. Any widespread dissemination of advance information as to a projected movement would defeat its own object. The so-called "tip" is mere guess-work, yet the public continues to use them largely as a basis for trading.

12. Too great facilities for obtaining information and executing orders is, to the ordinary trader, of no advantage, and is frequently a source of loss.

13. Speculation is a safe business when business methods are applied to it. The changes in prices of standard properties offer yearly greater opportunities for profit than any other field. That is to say, for reasonable profits, not for the amassing of fortunes on small capital , in a brief period, but for steady accumulation of value and knowledge.

What is fascinating about Mr Gibson's market musings is that despite the on-rush of modernity, rather little has changed in the world of stock market speculation. Recall that 1906 was before the jarring market 1907 break to occur the following year; before the first world war and market carnage, before the roaring twenties, before the crash and subsequent depression, and of course before computers, Fidelity and yes even Louis Ruykeyser hard as that may be to believe. In honor of the centennary of Mr Gibson's observations, I will summarize his thirteen major observations here for you (as he did in his foreword), after which you can make your judgements as to the extent to which the speculative state of affairs might have changed.

1. The greatest causes of loss in speculation are ignorance, over-speculation, and carelessness (listed in order of importance)

2. The popular fallacy that business methods are not applicable to speculation is wholly erroneous.

3. Not 1 speculator in 1000 applies ordinary business precaution to his trades nor founds his ventures on values.

4. The correct trader has little to fear and much to gain from manipulative tactics.

5. While extremes of prices move in irregular cycles, no "system" for judging changes is possible or tenable as such mechanical attempts to forecast prices changes do not contemplate changed conditions , or provide for accident.

6. The general idea that actual value and probable future value of a property cannot be intelligently based, is erroneous

7. The greatest speculative profits are made in stocks. The greatest speculative losses are made in commodities.

8. There are certain technical stages or conditions of markets which are followed by invariable results, the study and recognition of which is valuable, and not difficult.

9. Almost every general idea of speculation is the exact reverse of the truth. Somethimes this is caused by false reasoning, but most frequently as a result of false appearances of market quotations.

10. Persistent short-selling is fashionable amongst certain classes of semi-professional traders, but almost invariably results in loss.

11. "Tips" are illogical. Any widespread dissemination of advance information as to a projected movement would defeat its own object. The so-called "tip" is mere guess-work, yet the public continues to use them largely as a basis for trading.

12. Too great facilities for obtaining information and executing orders is, to the ordinary trader, of no advantage, and is frequently a source of loss.

13. Speculation is a safe business when business methods are applied to it. The changes in prices of standard properties offer yearly greater opportunities for profit than any other field. That is to say, for reasonable profits, not for the amassing of fortunes on small capital , in a brief period, but for steady accumulation of value and knowledge.

Wednesday, February 15, 2006

Infamy

Vinko Bogataj is the former Slovenian ski jumper, who for more than a deacde represented one of the most famous (or rather infamous) images on American television. His notoriety resulted from a most spectacular wipe-out off of a ski-jump platform that was prominently featured on Intro to ABC's Wide World of Sports. Bogataj was representing Yugoslavia at the World Championships in the Bavarian resort of Oberstdorf in the spring of 1970. It was his third jump of the day. Visibly heavy Snow was falling and the ramp was fast. Midway down, Bogataj attempted to abort his jump, but unfortunately lost his balance and careened out of control, off the end of the ramp, tumbling and cartwheeling wildly, then crashing through a retaining fence near stunned spectators before coming to a painful halt. Fortunately - and surprisingly given the ferocity of the crash - Bogataj suffered only a mild concussion. Though he returned to jumping the next year, he never duplicated his prior successes and retired from competitition, becoming a ski instructor, and supplementing his income by operating a forklift at a factory in his native Slovenia. Ask any American over the age of 30 about this swatch of video history, and they will confitm that he was, and forever will be known as the vivid image of the "Agony of Defeat".

Nui Onoue has a similar story from the bubble years in Japan. Known to few outside that country, and even fewer amongst the new breed of momentum-humping stock jockeys under the age of 30, her crash and burn tale is worth recounting here for it's sheer bizarreness, if not it's side-splitting humour.

Mrs. Onoue is said to have started her "professional" life working as a hostess in and around Osaka. There, she befriended a wealthy and it is said, influential owner of a large construction company. She then reportedly parlayed funds derived from this relationship into a restaurant called "Egawa" in Osaka's entertainment district of "Sennichimae". On the fourth floor of this restaurant resided a room, which was a soon-to-become-famous oracle-like chamber. And inside this room, was the amphibious source of her secret and her rise to power.

Over time, Mrs Onoue had developed a reputation amongst her customers for prescient stock market purchases. Whether this notoriety was sheer luck, or whether it was the result of acting upon material non-public information glenaed from her sugar-daddy remains a mystery. It should be pointed out however that insider trading was not an incarcertaing offense nor did it take a genius to make money on the long side of the market during these heady bubble years. Nonetheless, her admiring customers were keen to know the secret details of her apparent golden touch. And so she would lead them upstairs to the room on the fourth floor. Once in the room, they would be led to court with a one-metre high ceramic toad alledgedly imbued with strong buddhist-derived spiritual powers. At this point, she would apparently ask them to lay their hands on its head whilst she chanted some mantras followed by the revelations the toad's wisdom (through Mrs. Onoue, of course, as the medium) borne in the form of stock market tips.

Those remembering the great bubble would admit that while just being long during these years was enriching, all stocks were not created equal. Some issues experienced inexplicably meteoric rises of exponential proportions, baffling fundamental analysts and laying waste to short-sellers in their path. Some were undoubdtedly related to the revelations of the toad. Word of the Buddhist Amphibian's prescience spread quickly and she was soon visited by senior executives from the largest banks and brokerage firms in the Japan, including amongst others IBJ, Nomura, Yamaichi. Gaijin author, Alex Kerr, in his writings about the bubble recounted that by 1991, IBJ alone had lent her YEN240bn (~US Dollar $2 billion) and another 29 banks and other lenders had advanced her nearly the same again. Neighborhood observers attested to the queue of limousines lined up outside the restaurant, whose occupants presumably were awaiting the toad's latest financial advice.

"Leverage is poison!", an adamant hedge-fund investor once cautioned me in the immediate aftermath of Long-Term Capital. Mrs. Onoue could have benefitted from THAT wisdom as the dramatic popping of the bubble which sent the equity markets tumbling, carried out Mrs. Inoue, her portfolio, as well as many of her lenders. In the trial that eventually followed as authorities looked for scapegoats, she was sentenced to a 12-year stint in jail, ostensibly for using fake CD's as collateral for the jumbo loans that funded her speculative operations. And there was much collateral damage, the most notorious being the chairman of IBJ, once one of Japan's most powerful men, who was forced to resign in shame as a result of his relationship with Mrs Onoue and, of course, the toad. A decade later, a reporter from London's Financial Times with a sense for the surrreal)went relic-hunting in Osaka, in search of the toad, with a less-than-successful outcome. And so its whereabouts remain a mystery.

For years Bogataj had little clue regarding his notoriety as ABC's image of the Agony of Defeat until he was tracked down by a Pulitzer-winning American sports-writer with keen sense of human interest. And his story, while momentarily tragic, played out happily. Mrs. Onoue too, one might speculate, has remained ignorant of her global infamy (and that of her toad). While it all may have been as truly delusional as it appeared, I could spoil this story with the hypothesis that she was simply the front-person and the "patsy" for a group of slick stock operators who themselves were caught-out by the decimation of the Nikkei at the turn of the decade in 1990. But I won't do that here. Because 15 years on, with the recovery in Japan's share prices still relatively nascent, and fragile, and probably dependent upon the continuation of the housing bubble in the US and the continued vigour of America's consumers, in order that China can continue its heady growth without wretching, Japan, the Nikkei, and it's investors need fairytales.

Tuesday, February 14, 2006

Exam Questions I Would Like to Ask

When I eventually tire of playing this game, I've always fancied having a go at teaching. I'd finally have a good excuse to wear that tweed jacket hanging in my closet. Maybe even a colourful bow tie. Okay, NOT a bow tie else I am confused with that smug weenie, Tucker Carlson. And there are of course the oak-paneled rooms, the genteel debate, LBV port and ubiquitous other drink. (Bob Jones & Brigham Young U. excepted). Not that anyone would be silly enough to actually let me teach. But if perchance they did, one of my courses would be called "Fallacies of Finance & the Real-World Questions Stock Brokers & Financial Planners are too Ill-informed to Answer or Even Ask". It would be contentious to say the least. And it certainly wouldn't fly at any Economics Department that Fidelity or the Johnson family was endowing (at least if the Trustees had a say). For they would find it embarrassing to be responsible for the revelation of some of the stock market's dirtiest little secrets - one that might undermine public confidence, and shatter long-held illusions of fairness (not to mention offending their benefactors). For these are keystones of capitalism. Indeed, if this course were to be taught at all, it would be appear in the University's Course Directory in small-font italics, in a place where those of upstanding moral fiber rarely visit. It would be relegated to the red-light district equivalent of academia where those that did speak of it would only do so in hushed and disapproving tones.

The class would be rife with brain-teasing discussions and test questions that were NOT on the CFA Level III exam, nor likely to have been discussed by one's Ivy-league finance professor. For example, my mid-term might contain questions resembling something like this:

You've acquired a line of a smaller-cap stock, and you're trying to ramp its share price up (for obvious reasons of reputation & bonus/performance fees to buy your Ferrari or Humveek, etc.). Assuming you possess no reliable material non-public information, is it better to:

(a) be "Steady Eddie" & consistently buy more stock every day at higher & higher prices?

(b) "Go for the Gusto" and buy larger amounts with more marked impact, but only on selected meaningful days?

(c) Employ "Fear & Surprise" tactics by jamming it up hard, but do it randomly & less frequently (like Torquemada's Spanish Inquisition)

(d) Don't buy any more, but Hope & Pray for Divine Intervention.

Discuss.

Wow. So many degrees of freedom! Where does one start? First, what's the co's characteristics? Index membership? Expectations?, Short interest, amount of long margin or levered punters? It's Growth? Value? Momentum? Capital structure? "Quality"? Management acumen and integrity? Insider buying & selling? Prior return patterns? Speculative value (hidden assets, greenmail potential, net cash, cancer research, or solar cell research)? Ownership and float? Risk? Issuance of derivatives (options or CBs)? Borrowability & loan fees? Analyst following? Periodicity (Is it January or November)? Is anyone else operating in it, or likely to have an axe? That's for starters. One might also consider What's the objective - double it ? Triple it? More....?!!! How big a line does one have? Is it levered? How stable is YOUR capital or margin? How BIG are you (possible resources)? How diversified is your portfolio? What's the timing - a swing trade? A quarter? A fiscal year? Almost forever (e.g. Cap Research/Cap Guardian)?. As needed for "portfolio performance enhancement" purposes? Are you worried about the MOF? SEC? SFA? SFO? FSA? Is your compliance officer a weenie? Are you concerned about Exchange Regulators or the SIA (ha ha ha, only kidding on the last two). Whew. Decisions decisions. Even a good neural net would begin hemorrhaging.

Here are some hints to get the discussion going:

(a) Steady Eddie is an effective way to suck the punters in. Being 10 to 15% of daily volume (on the buy-side) will go a long way to insuring relative outperformance and the stock and endowing it with "alpha" (assuming it has reasonable characteristics & metrics and doesn't "suck"). There is no need to do anything dramatic (though on quiet or half-day sessions you can have some fun at low expense by buying everything in sight). From time to time, you'll encounter some short-term counter-trend selling and shorting, but if you keep to the plan, most will cover quickly and get squeezed out. The smart ones will certainly be able to see your resolve and will go away (for a while). Eventually you'll have taken out enough of the discretionary sellers to have your way with the price. About now, the, Libertarian trend-following crowd and/or the naive electronic herd will discover it and pile in. Use them to lighten up because by now you've probably achieved enough price appreciation to benefit your relative performance or achieve your mark. Of course you'll have to "get out a some point" without being beaten to a pulp but we'll discuss how to that that later.

(b) "Going for the gusto" has the advantage of being more economical. This is used by people who're cheap or who have probably bitten off more than they chew and want to conserve their bullets, or by those specifically looking for periodic mark-to-market performance and bang-for buck benefit from the money they've spend. The biggest advantage is that you spend less money buying up a stock that, in all honesty, you don't really want to own (especially at higher & higher prices), and in all probability after a period of time is overvalued and increasingly tempting for those itching to take a plunge on the short-side. The downside is that, like a burglar in winter, you've left some rather obvious tracks. Shorts will see your tracks, label you "a pretender" and lock-n'load. But that's not all. With Spitzer looking for fresh-kill in pursuit of high office, anything of dubious fiduciary integrity may be scrutinized - including the million shares you bought into the close on March 30th to move the price 7%. And the price of getting busted (or even accused) for a supposed fiduciary is not unlike a very very painful rectal itch. Not that getting your hand caught in the cookie jar has historically been fatal (it hasn't!) except in rare Alberto Vilar-like cases) where schizophrenia, cross-dressing serious, or vulgar theft are involved). Anyone from PBHG, Putnam, Baron or countless others will confirm that Sing-Sing is highly unlikely. In the end, though this method is not without some minor merit especially for the cavalier, but with the attendant risks it's probably more "penny-wise and pound foolish".

(c) Torquemada was horrible, brutal, but effective. There are virtually no Goldbergs or Cohens left in Iberia. Working randomly and in size is effective and helps prevent the market parasites from gaming you. You see, "Fear & Surprise" screws with their heads (and their strategies). You jam it up, and counter-trend sellers will see it. They wait. Watch carefully. Them it looks safe. So they drop some stock. The price drifts lower, they are confident they've made the right trade. Then, before they cover, like tasmanian devil, you let it rip and take it up 10 or 15%! The shorts are dumbstruck, bitter, kicking themselves for being greedy and are now looking to cover flat or at loss just to save their gonads. Afterwards, sellers see a tape that makes looks enticing to sell, but everytime they plunge they get hosed, so like a poisonous toad that wears bright day-glo colours to warn-off his would-be predators, so too does fear, surprise and randomness confuse people who otherwise might "get in your way" and make the operation more expensive and less profitable. Eventually you'll have to get out, and face the music, but in the end the only thing that really matters is average price, average price, average price.

(d) Since it is my observation that "market justice" (note: an SM & TM registered by Cassandra Does Tokyo)) which I would define as "things doing what they fundamentally "should" do, in the time frame that one expects that they will" is less prevalent than "things doing what things do (typically on account of the largest marginal investor)". Though chaotic, it's not complete chaos, but rather reasonably large amounts of noise with subsets of momentum in precisely the places where one might rather they weren't. This state of affairs is quite perplexing for amateur and professional investors alike. So where does prayer come into it? Well, if THIS is the product of intelligent design, then the "Deity in Charge", "Universal Architect" or who or whatever, must be one savagely sadistic supreme entity with one very twisted sense of humour. Given this reality, relying upon an appeal to her/its/his compassionate side to influence the future economic outcome of one's operation seems, IMHO, to be rater sub-optimal (not to mention a waste of time).

FOR EXTRA CREDIT: (bonus prize being a genuine vintage Made in Japan "Kewpie Doll"): In the operation described above, What do you do when you run into a real [and apparently large] seller?

(a) See how price sensitive he is

(b) Puke

(c) Take him out

(d) Hope & Pray for Divine Intervention

(e) Telephone Nick Leeson for advice

(f) none of the above

(g) all of the above

(h) both a & b

Sample Answer (I invite you all to take a stab): A Democrat would test the waters, get touchy feely and see how price sensitive the seller is. An Ayn Rand Libertarian would understand the implications of a large seller, decisively place a tight sell stop, and wait to see which way the wind will blow. But a real man, one with "cojones" the size of a Texas Republican for example, would throw caution to the wind, irrespective of the odds and costs and "take him out". Or try at least. Kind of like what the US has done in Iraq.

Of course what is described above is theatre. But like all good theatre, it's based upon kernels of truth. As such, comments from the real-world are encouraged.

Monday, February 13, 2006

New vs. Old Japan

So Takefumi Horie's Livedoor boys have spilled the beans, admitting guilt in respect of, amongst other things, securities law violations as accused by the authorities. This comes as no surprise to the more cynical (and older it must be said) observers who view such meteoric and iconoclastic rises (in share price and public notoriety) with a healthy dose of skepticism - especially where accompanied by shenanigans that push the limits of what even an optimist might call the "invisible hand" of the market.

I do not wish to judge Mr Horie too hastily despite the fact that his minions HAVE already admitted guilt. But what really strikes about today's admission by Mr. Horie is his decidely un-Japanese way of confronting what, in all probability, is the objective reality of his guilt. For he has rather shamefully denied it in all respects. Thus, Mr Horie really is NOT "old Japan", which to his credit, he has consistently distanced himself from, and tried to upstage, but rather "New America". For rather than "fess-up" and apologize when caught red-handed (like almost all of the more honorable Japanese businessmen and politicians), Mr Horie has taken a page from the infamous legal playbooks of Bernie Ebbers, Richard Scrushy, Ken Lay, Jeff Skilling, the Rigas', and yes, the King of Dishonorable Denial, I. Lewis ("Scooter") Libby, and deny both responsibility and guilt.

Bernie Ebbers, Richard Scrushy, Ken Lay, Jeff Skilling, the Rigas', and yes, the King of Dishonorable Denial, I. Lewis ("Scooter") Libby, and deny both responsibility and guilt.

But the equivalence between Mr Horie and new America stops there. For while "New America" is driven by the same unadulterated avarice the seemingly drove Mr. Horie, and while the American justice system allowed Mr Scrushy to get off Scott-free, I do not believe Mr Horie will be so fortunate. I say this because the greed factor of "New America" was parochial and not only wasn't it a direct challenge to authority, it was in complicity with it (until the Cheney Administration and other politicos cut them loose when they were an embarassment). Mr Horie on the other hand was directly and unabashedly challenging established authority, practice, privilege and control in a society where the "wah" (harmony) of the house has traditionally been a cornerstone to the healthy functioning of Japanese society. And it is this "crime" which will insure that whatever Mr Horie may or may not have done, he will not get off so lightly as many of his "New America" counterparts.

I do not wish to judge Mr Horie too hastily despite the fact that his minions HAVE already admitted guilt. But what really strikes about today's admission by Mr. Horie is his decidely un-Japanese way of confronting what, in all probability, is the objective reality of his guilt. For he has rather shamefully denied it in all respects. Thus, Mr Horie really is NOT "old Japan", which to his credit, he has consistently distanced himself from, and tried to upstage, but rather "New America". For rather than "fess-up" and apologize when caught red-handed (like almost all of the more honorable Japanese businessmen and politicians), Mr Horie has taken a page from the infamous legal playbooks of

Bernie Ebbers, Richard Scrushy, Ken Lay, Jeff Skilling, the Rigas', and yes, the King of Dishonorable Denial, I. Lewis ("Scooter") Libby, and deny both responsibility and guilt.

Bernie Ebbers, Richard Scrushy, Ken Lay, Jeff Skilling, the Rigas', and yes, the King of Dishonorable Denial, I. Lewis ("Scooter") Libby, and deny both responsibility and guilt. But the equivalence between Mr Horie and new America stops there. For while "New America" is driven by the same unadulterated avarice the seemingly drove Mr. Horie, and while the American justice system allowed Mr Scrushy to get off Scott-free, I do not believe Mr Horie will be so fortunate. I say this because the greed factor of "New America" was parochial and not only wasn't it a direct challenge to authority, it was in complicity with it (until the Cheney Administration and other politicos cut them loose when they were an embarassment). Mr Horie on the other hand was directly and unabashedly challenging established authority, practice, privilege and control in a society where the "wah" (harmony) of the house has traditionally been a cornerstone to the healthy functioning of Japanese society. And it is this "crime" which will insure that whatever Mr Horie may or may not have done, he will not get off so lightly as many of his "New America" counterparts.

Subscribe to:

Comments (Atom)